Computing Activity Rates Which Are Used to Assign Overhead Costs

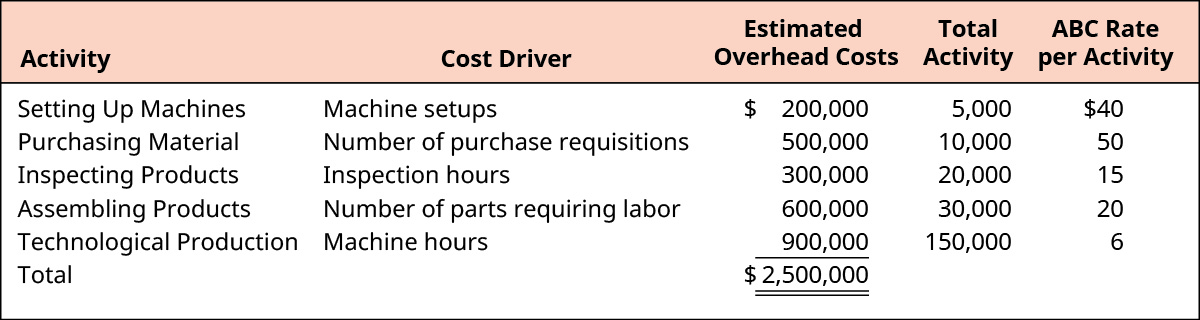

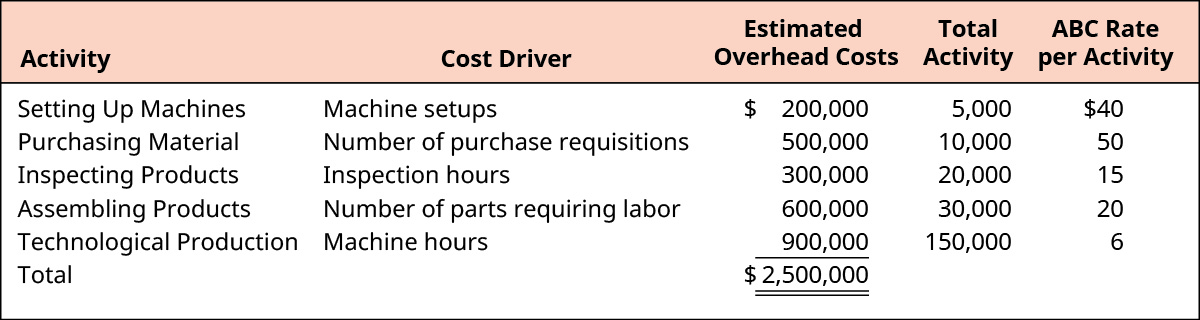

So 1012505625 18 per labour hour. Assume that manufacturing overhead for Glassman Company in the previous exercise consisted of the following activities and costs.

Solved 1 Assign Overhead Costs To Activity Cost Pools Chegg Com

The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or produced in.

. 2640000 1800000 Units. In activity based costing an activity cost_____is the factor which causes costs in the pool to be incurred. Activity Cost Pools Activity 1 Activity 2 Activity 3 The cost per unit of Product B is closest to.

The cost driver rate which is the cost pool total divided by cost driver is used to calculate the amount of overhead and indirect costs related to a particular activity. Of direct labour hour. A 4158 B 8153 C 7473 D 1769 Question Details AICPA.

Overhead Rate 40000 5000. 16000 8000 Unit cost. The more complex of the two products requiring 3 hours of direct labor time per unit to manufacture compared to 2 hours of direct labor time for Product S.

Cost QuantityAmount QuantityAmount Consumed by Activity Cost Pools Assigned Consumed by Materials handling Cost Driver to Pool Basic Luxury Number of moves 3600 20 moves 55. Computing Plantwide Overhead Rates. 1560000 520000 Total cost.

Computing activity overhead rates using ABC. Hazelnut has a total of 145920 in overhead. 165 225 Overhead assigned.

Given direct material cost of 10 direct labor cost of 15 direct-labor based overhead of 12 and Activity-Based Costing overhead of 16 the total cost of the product using Activity-Based costing is. Calculate the cost of Job 845 using ABC to assign the overhead costs. The first step in applying activity based costing is.

Standrd 05 hrs per unit 10000 units 5000 hs Speciaty 025 hrs per unit 2500 units 625 hrs Total no. Production scheduling 400 batches 60000. Traditional costing systems allocate manufacturing overhead by dividing total indirect costs by a cost driver to obtain one rate to be used to allocate.

It is calculated by taking the cost pool total and dividing it by the cost driver. Activity rates total cost of each activity total activity Activity rates are used to apply overhead costs to products and customers in the _____-stage allocation. Calculate the cost per unit of activity driver for each activity cost category.

QS 17-13 Computing activity rates LO P3 A manufacturer uses activity-based costing to assign overhead costs to products. Product W is produced on an automated production lineOverhead is currently assigned to the products on the basis of direct-labor-hours. The company estimated it would incur 912811 in manufacturing overhead costs.

Setup 1000 setup hours 144000. Activities which are focused at the unit level are called unit level activities Activities causing overhead include all of the following. Calculate the cost of Job 845 using the plantwide overhead rate based on.

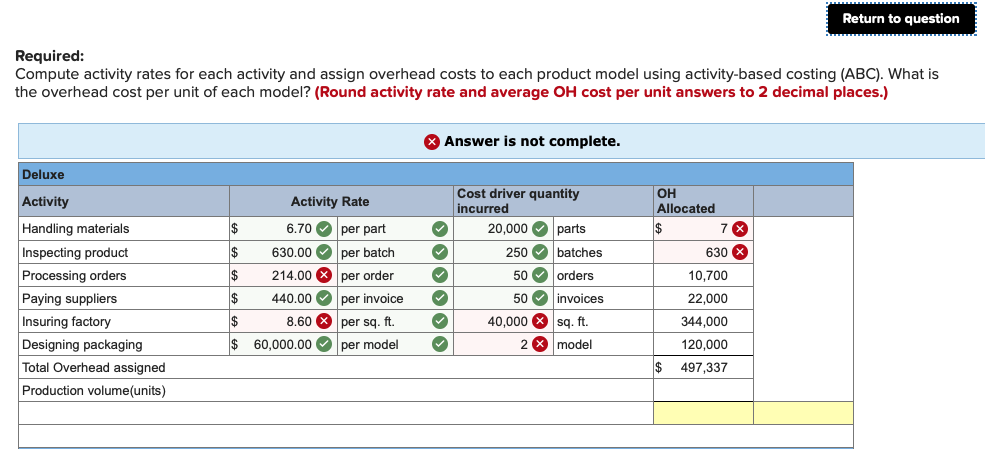

Compute activity rates used to assign overhead costs to final costs such as products. 8 per customer call and 15 per development hour Activity rates are used to apply overhead costs to products and customers in the 1-stage allocation. Overhead rate 20800008000 260 per direct labor hour Model A Model B Direct materials.

Computing activity rates which are used to assign overhead costs to products in activity-based costing is determined in. Budgeted cost information for selected activities for next year follows Activity Purchasing Cleaning factory Providing utilities Expected Cost 135000 32000 65000 Cost Driver Purchase orders Square feet Square feet Expected. Chapter 4 Learnsmart - Chapter 4 Learnsmart Computing.

Calculate the cost of Job 845 using the plantwide overhead rate based on machine hours calculated in the previous exercise. Overhead Rate 8 per working hour Explanation. Proper determination of this depends on the following.

This assignment will allow you to practice applying activity-based costing ABC which includes classifying activities on a unit level batch level product level or facility level. Total overhead cost 101250 No. And determining overhead cost per unit based on given information.

The annual production and sales of Product A is 200 units and of Product B is 400 units. Calculate the cost of Job 845 using ABC to assign the overhead costs. Activity-based costing ABC is a method to determine the total cost of manufacturing a product including overhead.

Of hours 5000 625 5626 hrs Then a common overhead rate can be calculated taking the base as direct labour hours. Calculate the cost per unit of activity driver for each activity cost category. Using activity-based costing calculate the appropriate activity rates.

Chapter 4 Learnsmart Computing activity rates which are used to assign overhead costs to products in activity-based costing is determined in Step 3. 600000 800000 Direct labor. 1 Proper identification of the factor that drives the cost in each activity cost pool.

480000 480000 Overhead. Calculating Activity-based Costing Overhead Rates. The company has identified the following information about its overhead activity cost pools and the two product lines.

When using activity rates overhead is assigned the same way as when using plantwide or departmental rates. There are three activity cost pools with total cost and activity as follows. This preview shows page 1 - 2 out of 4 pages.

Solved A Manufacturer Uses Activity Based Costing To Assign Chegg Com

Calculate Activity Based Product Costs Principles Of Accounting Volume 2 Managerial Accounting

Solved Return To Question Exercise 17 5 Assigning Costs Chegg Com

No comments for "Computing Activity Rates Which Are Used to Assign Overhead Costs"

Post a Comment